Israeli satellite firm surges 160% amid Starlink, Amazon expansion

The Israeli broadband communications company Gilat Satellite Networks is drawing investor interest, with its market value increasing 160% as industry giants such as Starlink and Amazon compete to expand satellite deployments. Operating in multiple countries – including Israel, the United States, Australia, India and Mexico – the company benefits from the global satellite race by supplying the ground-based infrastructure that enables connectivity. Listed on both the Nasdaq and the Tel Aviv Stock Exchange, Gilat has seen its market capitalization climb to approximately $1.1 billion (NIS 3.5 billion).

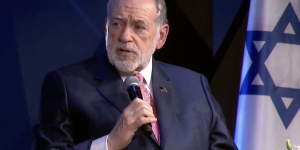

While successful today, Gilat CEO Adi Sfadia reflected in an interview with Ynet News on the company’s past challenges, including several years without profits.

"After the 2010 acquisitions of Wavestream and RAYSAT, the company entered years without profits. In 2015, I joined amid profit warnings and losses. As CFO, together with then-CEO Yona Ovadia, we led efficiency measures and refocused on profitable deals. That returned us to profitability," Sfadia said.

He noted that the company stands out as a veteran among largely young Israeli startups.

"Gilat has been in business for 39 years, and what we do today is largely what we did in the past, with some adjustments," Sfadia said. "Our core focus is satellite internet. We build the communications equipment that enables it. We operate powerful transmitters and receivers in gateway stations with very large antennas. On the other side, the equipment connects to our VSAT modems. You say, 'I want to view Ynet', hit enter and the signal goes up to the satellite."

"Over time, we focused on areas where we deliver greater value. Our current focus is on very high-throughput satellites. These geostationary satellites can deliver hundreds of gigabytes per second. In the past, they managed only about 10 gigabytes," Sfadia continued.

He placed the company’s business within the larger context of satellites and as a supplier to Amazon.

"Today we operate in network equipment for GEO and MEO satellites," Sfadia explained. "In LEO, we are competing for several projects. We supply equipment to Amazon’s Kuiper project and are bidding on major initiatives, including IRIS, the pan-European satellite constellation aimed at reducing Europe’s dependence on the U.S., Donald Trump and Elon Musk."

He spoke about the company’s $100 million acquisition of Stellar Blu, a developer of electronically steered antennas.

"Every business involves some risk and some luck," Sfadia said. "We identified market trends correctly. We are a major player in in-flight connectivity, hold more than 25% of the amplifier market and are strong in modems with Intelsat and SES. We always wanted to be a player in the antenna market, so we chose a faster route."

Sfadia also compared Gilat’s position to Elon Musk’s Starlink.

"Starlink does not compete with us directly, but with our customers," he said. "But when it wins over our customers, they buy less equipment from us. I think that right now we are in a very unique situation. Starlink is not winning customers on price, but because it has excess capacity.”

Last August, Starlink began offering satellite service in Israel. Looking ahead, Sfadia is optimistic and expects the company to continue growing and potentially acquiring smaller companies.

Starlink connectivity was recently offered to Iran following an internet blackout imposed by Iranian authorities amid ongoing unrest.

The All Israel News Staff is a team of journalists in Israel.

You might also like to read this: