Trump administration 'very troubled' by Norway's divestment of US firm Caterpillar over sales to Israel

Senator Graham warns of possible consequences for Norway and the sovereign fund managers

The U.S. State Department said on Wednesday that it is “very troubled” over a decision by Norway’s sovereign wealth fund to divest from the American firm Caterpillar, one of the world’s leading manufacturers of construction and mining equipment, over its sales to Israel.

The decision of the $2 trillion fund to divest from Caterpillar, announced last week, marks the first time that the Norwegian fund divested from a non-Israeli company over use of products by Israel.

The fund said the move came at the recommendation of its ethics advisor, which said that Caterpillar products, including bulldozers and excavators, are being used by Israeli authorities "to commit extensive and systematic violations of international humanitarian law" including "widespread unlawful destruction of Palestinian property.”

The fund further claimed that Caterpillar “has not implemented any measures to prevent such use.”

A spokesperson for the U.S. State Department said, “We are very troubled by the Norwegian sovereign wealth fund's decision, which appears to be based on illegitimate claims against Caterpillar and the Israeli government. We are engaging directly with the Norwegian government on this matter.”

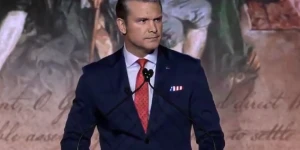

Republican Senator Lindsey Graham, a vocal supporter of Israel, took to social media to post a reaction, warning the fund administrators that there could be consequences for the decision.

“To those who run Norway’s sovereign wealth fund: if you cannot do business with Caterpillar because Israel uses their products, maybe it’s time you’re made aware that doing business or visiting America is a privilege, not a right,” Graham posted. “Maybe it’s time to put tariffs on countries who refuse to do business with great American companies.”

To those who run Norway’s sovereign wealth fund: if you cannot do business with Caterpillar because Israel uses their products, maybe it’s time you’re made aware that doing business or visiting America is a privilege, not a right.

— Lindsey Graham (@LindseyGrahamSC) August 28, 2025

Maybe it’s time to put tariffs on countries who… https://t.co/KAcOBunzbC

Graham also suggested placing visa restrictions on managers of the sovereign wealth fund.

The Norwegian sovereign wealth fund has been accelerating its divestment from Israeli companies. Just one week prior to the announcement, it sold stakes in 11 Israeli firms.

The divestment effort comes as Norway prepares for parliamentary elections next week, with many smaller parties calling on the fund to divest from all Israeli companies. Previously, the fund has only divested from Israeli firms doing business in the territories of Judea and Samaria, which it refers to as “occupied Palestinian territories.”

It has already blacklisted companies such as Paz, an Israeli fuel station firm, as well as the telecommunications company Bezeq.

The All Israel News Staff is a team of journalists in Israel.

You might also like to read this: