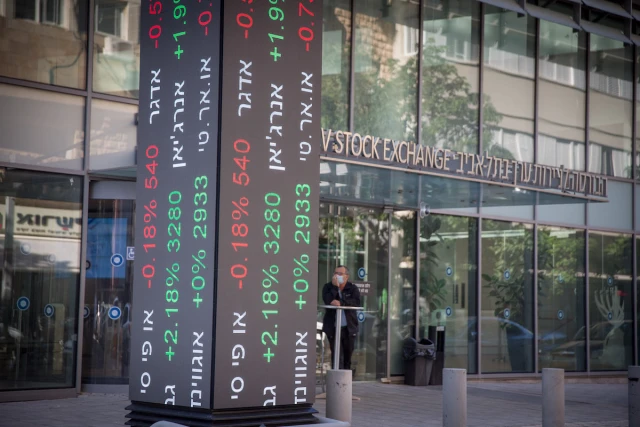

Sky-high trading volume on Israel’s stock exchange in May, despite ongoing war

Looking back after Shavuot – the Feast of Weeks – analysts noted a strong performance on the Tel Aviv Stock Exchange during May 2025.

Despite the long drawn out war with Hamas and other Iranian proxies, Israel’s troubles do not seem to have deterred foreign investors. The Tel Aviv Stock Exchange reported that in May alone foreign investors bought $700 million worth of Israeli stocks. Overall this year, foreign acquisitions have totaled some $2.55 billion.

The Tel Aviv Banks 5 Index rose by almost 10% in May, extending its year-to-date gain to about 30%, fueled by strong first-quarter earnings according to YNet.

Israeli banks also reported record profits, with Bank Hapoalim earning a profit of $756 million, Bank Leumi $672 million, Mizrahi-Tefahot $364 million and the Israel Discount Bank gaining a $98 million profit.

Overall, 70% of the foreign investment went to banks with strong earnings, with defense firms also drawing significant interest. Due to the necessary developments in defense manufacturing, the sector has been booming with $1.4 billion coming from foreign investment in defense industry stocks since the beginning of the year.

Quarterly earnings reports published in May appear to have contributed to the strong market performance. The Tel Aviv 35 Index rose by 4.6%, the TA-90 by 5.5%, the TA-125 by 6%, and the TA-SME60 by 5.5%. In comparison, money market funds – considered a safer investment – offered returns of up to 4%.

Sector indices also posted gains, according to YNet, with the strongest performances in banking and insurance (up 7.9%), as well as the telecom and tech sector (up 6.9%). The exchange also welcomed a new listing in May: Eldan, a vehicle leasing and rental company, became the seventh company to launch an initial public offering in 2025.

Ehud Nir of the Tel Aviv Stock Exchange’s research department commented on the encouraging reports:

“Despite ongoing fighting in Gaza and missile launches from Yemen, trading in May 2025 was marked by rising prices and market stability,” he said, adding, “A missile landing near Ben Gurion Airport caused temporary concern, but had no lasting impact on the market. Meanwhile, Q1 earnings reports provided a tailwind, along with positive global developments such as U.S. trade deals with key partners, including China.”

Jo Elizabeth has a great interest in politics and cultural developments, studying Social Policy for her first degree and gaining a Masters in Jewish Philosophy from Haifa University, but she loves to write about the Bible and its primary subject, the God of Israel. As a writer, Jo spends her time between the UK and Jerusalem, Israel.

You might also like to read this: